As AP departments continue their digital transformation, identifying the ideal AP automation solution can be tough. There are plethora of solutions available today, but not every solution is equipped to meet all your company’s needs. And when you dig into the various options, it can be hard to know which features are all hype and which genuinely matter.

To help you achieve the best AP automation results possible, we’ve compiled a list of the top 8 must-have qualities to look for in your search.

Inside the 8 Must-Have Qualities to Look for in an AP Automation Solution

Top 8 Must-Have Qualities to Look for in an AP Automation Solution

1. Easy and Convenient Invoice Approvals

Your invoice approvers, likely managers and executives, have a lot on their plates. They don’t have time to waste on convoluted invoice approval processes. Making invoice approvals easy and convenient for approvers is non-negotiable. Look for an AP automation solution that allows users to view and approve invoices with a single click. For the sake of flexibility, they should be free to perform this task on any device, anytime, anywhere.

You should also look for a solution that makes it easy for your accounting department to create, edit, and manage invoice approval workflows. Processes change over time. Plus, with The Great Resignation in full swing, staff turnover is high and often unexpected. The right AP automation solution can make adapting to changes like these easier using drag and drop workflow tools. Your accounting admins will thank you.

2. The Ability to Track AP Invoices Through the Entire Process

The lack of visibility into the status of an invoice is one of the most frustrating aspects of manual AP processing. It results in lost invoices and late payments, hurting vendor relations. With the right AP automation, you should have easy access to invoice statuses and other relevant information. Even if your approval workflow is highly complex, you should have real-time insights, any time, from anywhere.

3. The Ability to Automate All Aspects of the Invoice-to-Pay Process

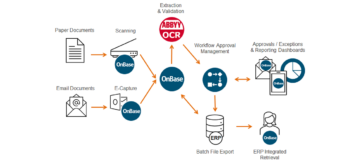

Some AP automation solutions only range from document management to invoice workflows to payment execution only. You want a solution that covers all four components of the invoice-to-pay process: invoice capture, invoice approval, payment authorization, and payment execution. Here’s what to look for in each:

- Invoice capture rids you of manual data entry using OCR technology. Some solutions also require human review for added accuracy. Additionally, be aware that some solutions like OnBase extract header and line level information while others don’t.

- Invoice approval cuts back on time spent locating invoice approvers. It enables you to automatically route invoices to the appropriate people based on preset rules regarding invoice coding, amount, or vendor. If you have a more complex invoice approval process, note that some solutions place limits on the number of approvers per invoice, charge per additional invoice approver, and lack simultaneous approvals.

- Payment authorization makes your CFO’s life easier, making it easy to review and process payments. If your organization requires two signatures above a specific dollar amount, look for a solution that supports dual payment authorization.

- Payment execution allows your organization to process all vendor payments, regardless of type or format. Confirm that your AP automation solution can accept all payment methods you encounter.

4. User-Friendly Interface

A user-friendly interface is VITAL to your AP automation implementation’s success. Not only does it mean a smoother learning curve for your employees, but it increases your chances of higher user adoption. Look for a dashboard that’s uncluttered and neat, allowing users to access the most-used functions instantly. Built-in functions are an asset too, as they help employees to manage accounts and perform tasks more easily.

5. Solid Integrations with Your Accounting Systems

You need an AP automation system that integrates into your existing ERP system seamlessly. For best results, your solution should be able to natively build on your existing ERP systems’ logic, leverage its data, and use its core infrastructure to further streamline automation. It’s best to avoid having to build APIs and ad-hoc integration frameworks, if possible, as these efforts can be time-intensive and expensive. At Naviant, we’ve seen the huge difference a seamless integration can make. Our customers have found success integrating OnBase AP automation with a variety of accounting systems, including:

- SAP

- Workday

- Microsoft Dynamics 365

- JD Edwards EnterpriseONE

- Deltek Costpoint

- Oracle E-Business Suite

- Infor

- Great Plains (see case study below for more information.)

Want to know more about how Clay Lacy Aviation boosted its efficiency in its AP department and beyond using these two solutions? Get the full story in our new case study.

Clay Lacy Aviation’s OnBase & ABBYY FlexiCapture Success Story

6. Accurate Invoice Data Capture

Data capture is a massive force behind AP automation’s ability to boost efficiency. As you’ll see in our AP automation customer stories, many organizations grapple with how expensive, time-intensive, and error-prone manual data entry can be pre-automation. But automated data input must be accurate to drive home optimal savings. Be sure to investigate the accuracy rate of AP automation solutions before selecting. Many solutions only reach 70-90% accuracy rate, while the best solutions offer as much as 99.5%.

7. Autonomous Capabilities

For a truly intelligent AP automation solution, consider a solution with autonomous capabilities, like the Naviant AP Accelerator platform. This powerful technology uses machine learning and natural language processing, together known as AI. It can perform complex processing of unstructured information without need for human intervention or templates. It’s also flexible and can react as data and circumstances change, allowing it to make precise decisions and predictions.

Learn more about autonomous capabilities and the Naviant AP Accelerator platform.

Accounts Payable (AP) Accelerator

8. The Right Partner

In addition to finding a solution that hits all your non-negotiables, you need an experienced partner you can trust. No matter what technology you choose, your project is likely to suffer if planning, implementation, and training are rushed or poorly handled. A great solution provider should comprise of workflow experts and software developers that can guide and support your team throughout the project. They will work with you to customize your solution and help you make changes and improvements during and post-implementation as needed.

Finally, look for a partner with a robust customer support team and training offerings. Having these resources available will ensure your transition to AP automation goes smoothly. It can also help your team stay up to date on system updates, brush up on their skills, and get inspired to innovate further.

Start Your AP Automation Journey with Confidence

Pursuing AP automation is a critical step for accounting departments in the digital age. It saves money, time, and your company’s reputation with vendors. Beyond these benefits, it makes your staff’s jobs less frustrating and more enjoyable, which can increase employee loyalty. And, to maximize these benefits, you need the right solution and provider. We’d love to help you in your search for AP efficiency. Drop us a question in the chat to start a conversation.

Want More Content Like This?

Subscribe to the Naviant Blog. Each Thursday, we’ll send you a recap of our latest info-packed blog so you can be among the first to access the latest trends and expert tips on workflow, intelligent automation, the cloud, and more.