Accounts payable teams play a critical role in business operations and have the potential to make a profound impact on the company at large. But the high volume of time-consuming, error-prone manual AP processes that AP teams face can severely inhibit that impact. As a result, employees are often limited to accomplishing little more than simply getting the bills paid, sometimes even late.

AP automation software empowers AP departments by eliminating these manual processes and comes with a variety of benefits. This technology can take over a variety of critical tasks. For example, a single solution can manage approvals, submit invoices, and process payments. Additionally, it can even provide better control and visibility over your processes and data.

Top 5 AP Automation Benefits

1. Increase Process Accuracy and Consistency

AP automation can significantly improve your payment accuracy, with the top AP automation tools capturing invoice data at 99.5% accuracy. According to the Institute of Finance and Management (IOFM), about 3.6% of supplier invoices manually generated have errors, which can be time-consuming to correct and can even tarnish company credibility if left unfixed. AP automation can eliminate human errors from your AP processes altogether. Better yet, it can even identify errors and fix them with little human intervention.

AP automation also standardizes your invoices’ data into workflows, making for reliable consistency in your AP processes and streamlined payments.

2. Grow and Scale Without Adding Headcount

As your organization grows and your business volume increases, you can keep up. You won’t even need to hire additional employees to stay on track. AP automation technology allows you to customize your own business rules that fit your unique needs. Then, your solution uses these rules to automatically deliver your invoices to the right people for approval.

When your business’ needs change over time, you can make real-time changes to your approval processes without involving your IT department. This way, your AP department can seamlessly support ongoing company growth without stress or additional resources.

3. Reduce Costs

It can cost as much as $8 – 10 on average to manually process a single invoice. That price adds up fast! With AP automation, however, you can decrease your invoice processing cost to $2 per invoice.

Automating your AP processes can also lead to cost savings through early-payment discounts. According to IOFM, most businesses receive under 21% of these offers, and 12% don’t receive any early-payment discounts. AP automation can even help you avoid late payment penalties.

4. Fraud Protection

According to the 2022 AFP Payments Fraud and Control survey, an estimated 71% of companies were targets of payments fraud attacks in 2021 alone. AP automation can help you escape this statistic by helping you:

- Go 100% paperless

- Closely monitor which employees have access to invoice approval & release of payments

- Minimize human input in the AP process

- Improve internal controls & transparency

These solutions also enable you to build approval workflows requiring each invoice to pass through multiple parties for approval before the payment is processed. This way, your chances of catching potentially fraudulent invoices before it’s too late are far greater. Plus, it’s a safeguard against missing or incorrect data, further enhancing your process’ accuracy.

5. Quick Return on Investment (ROI)

Freeing your employees from time-consuming and tedious manual processing can make a big impact. When you implement your AP automation solution, there’s a good chance that you’ll see results relatively early on. In our experience working with finance departments, we’ve seen about 300% increases in productivity per employee. Additionally, we’ve seen finance departments enjoy AP paybacks within less than a year and over 60% processing costs improvements per invoice.

Even Faster Impact with the Naviant AP Accelerator

Despite all its benefits, rolling out a brand-new solution can appear daunting. That’s why we created the Naviant AP Accelerator, a ready-to-use intelligent automation solution. The Naviant AP Accelerator is designed to put your AP automation project on the fast track so you can start enjoying the benefits sooner and save money in the process.

How It Works

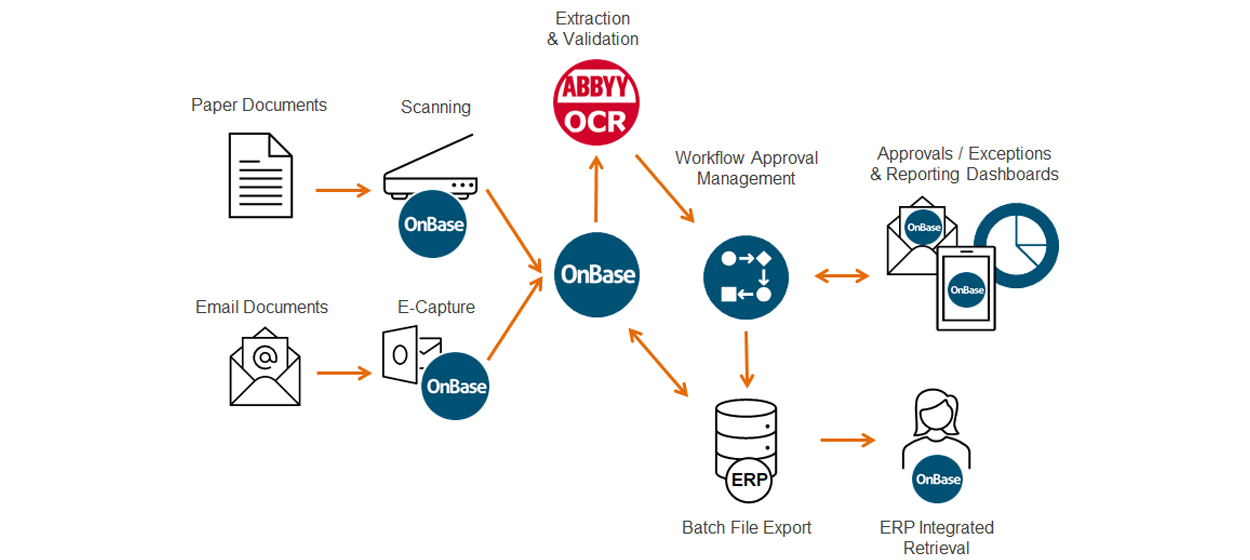

The Naviant AP Accelerator combines two powerful software solutions, ABBYY FlexiCapture for Invoices and OnBase document processing.

Naviant AP Accelerator uses ABBYY FlexiCapture for Invoices to automatically ingest invoices from an email box and classify each one appropriately. Using AI, it then extracts important information from the record, validates and cross-checks it against the ERP master data, and it’s automatically routed for approval. Then, OnBase takes over to efficiently manage each invoice, providing automation controls for GL approvals, human exceptions, and reporting analytics.

We’ve seen these two technologies work together to deliver outstanding results. In fact, Naviant customer Clay Lacy Aviation, used ABBYY FlexiCapture and OnBase to:

- Boost its efficiency by automating 95% of its invoices

- Decrease a 10% error rate to 0.2% for their invoice processing

- Go 100% paperless in its expense report process

“Integrating OnBase and ABBYY into our operation allowed us to realize the full potential of an automated workflow solution that has proved to be nothing short of a gamechanger for Clay Lacy Aviation.” –Brad Wright, Chief Financial Officer, Clay Lacy Aviation

Clay Lacy Aviation’s OnBase & ABBYY FlexiCapture Success Story

Want to know more about how Clay Lacy Aviation boosted its efficiency in its AP department and beyond using these two solutions? Get the full story in our new case study.

Want More Content Like This?

Subscribe to the Naviant Blog. Each Thursday, we’ll send you a recap of our latest info-packed blog so you can be among the first to access the latest trends and expert tips on workflow, intelligent automation, the cloud, and more.