If you’re looking to tackle your scaling challenges, look no further than your AP department. AP departments are weighed down by a high volume of manual processes. These tasks aren’t just time-consuming and mundane; they also rob you of precious time, money, and scaling potential. Fortunately, AP automation can eliminate manual processes and streamline AP operations. AP automation promotes accounts payable growth and overall company growth by accelerating processes and delivering many other valuable AP benefits while remaining cost-effective. Let’s explore six ways AP automation can help you scale your business.

6 Ways AP Automation Can Help You Scale Your Business

1. It Increases Your Productivity

Every second of your employees’ time is valuable. AP automation allows them to channel more of it into activities that boost business growth. Without paper and manual processes consuming their time, your employees will have time to be productive in other capacities within your organization. For example, they may use AP automation’s tracking tools like dashboards to measure key metrics like the average number of invoices, invoice processing time, and cost per invoice. If you can track it, there’s probably room for improvement. And better, faster processes are sure to set you on the path to accounts payable growth and overall company scalability.

2. It Enables You to Handle More Invoices

It can be nearly impossible to manage high invoice volumes without increasing headcount. But who has the budget for that? Without the ability to handle more invoices, your growth will lag. However, AP automation can automate the manual tasks involved with invoice processing. You can then handle an unlimited number of invoices, which supports growth. This way, you won’t have to hire additional staff, and your current AP team can trade tedious manual work for more exciting projects that benefit your organization.

3. It Helps You Save Money

According to a 2022 APQC study, top-performing organizations pay only $1.42 per invoice processing on average, while the lowest performers pay almost five times as much at $6.00. That’s the difference between organizations that have used technology to transform their AP processes and those that have not.

Beyond cost per invoice, AP automation also saves you money by reducing or eliminating:

- Late fees

- Managerial overhead

- Facilities

- AP staff overtime

- Additional hiring

- Supplies

- IT support

- Human error

AP automation also lets you cash in on cashback deals and early-payment discounts. That’s a huge win, as most businesses receive under 21% of these offers, and 12% don’t receive any. And decreasing your expenses means you’ll have more funds to re-invest in endeavors that scale your organization.

4. It Improves Your Vendor Relations

Manual AP processing is prone to delayed payments, as the invoice approval process can take as long as two weeks. Unfortunately, long waits lead to frustrated vendors, which hurts your reputation. AP automation can cut down payment times to three days or less, thanks to automated workflows accelerating the approval process. As soon as this technology processes an invoice’s data and matches it to the PO, it automatically sends it to the correct approver. AP automation’s high accuracy also means that you’ll be able to offer fast, smooth service consistently. Knowing this, your vendors will want to prioritize working with you and may even spread the word, helping your business expand further.

5. It Enhances Your Data Visibility

Lack of data visibility is a common obstacle to organizational and accounts payable growth. Many organizations have a hefty data supply but lack the tools to access or use it to their advantage. AP automation clears this hurdle by offering full visibility with comprehensive insights into each stage of the AP process and cash flows.

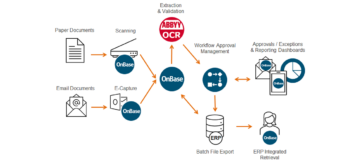

With enterprise platforms like the Naviant AP Accelerator, you can directly access data across your processes and invoices, vendor contracts, and receipts from your ERP. In addition, it provides functionality like interactive reporting dashboards, which offer a real-time look into the status of invoice approvals and exceptions. Managers can then use this tool to make approvals and reassign tasks. You can then use all this information to pinpoint problems holding your processes back, driving continuous real-time improvement. Plus, you have all the insights you need to make more informed decisions that scale your business.

6. It Keeps Up with Your Changing Needs

Your business volume and needs will regularly change on your journey to growth. Fortunately, AP automation, being a highly scalable solution itself, can help you keep up without adjusting staff count or resources. This technology follows the customizable business rules you specify and does so with high accuracy and speed. And when conditions change, you can easily make real-time changes to your approval processes without calling IT. As a result, you can seamlessly accommodate ongoing company growth without stress or needing a new system or resources.

Your Company’s Scalability Starts with Accounts Payable Growth

If your business is going to grow and thrive in the long run, you must keep up with process-accelerating technology. Your customers demand better, faster service, which is a pursuit that your AP department can have a massive impact on. That’s why investing in AP automation is such a powerful step forward in your journey to growth.

Accounts Payable (AP) Accelerator

Learn more about autonomous capabilities and the Naviant AP Accelerator platform.

Want More Content Like This?

Subscribe to the Naviant Blog. Each Thursday, we’ll send you a recap of our latest info-packed blog so you can be among the first to access the latest trends and expert tips on workflow, intelligent automation, the cloud, and more.